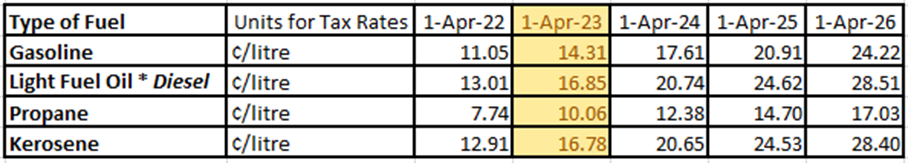

The Federal Fuel Charge (Carbon Tax) will be increasing on April 1, 2023 in all applicable provinces, including Alberta, Saskatchewan and Manitoba. Please see the table below for the list of the relevant fuels at UFA that are subject to this change effective April 1, 2023:

As a reminder, the Federal Government has announced targeted relief for certain sectors including but not limited to, a farmer, if and only if all the following criteria are met:

- the fuel is "qualifying farm fuel" (which is defined as gasoline or diesel that is for use exclusively in the operation of eligible farming machinery and that all or substantially all of the fuel is for use in the course of eligible farming activities). [Note that propane is not exempt for farmers]

- the fuel is delivered to the farmer at a farm or cardlock facility;

- all or substantially all of the fuel is for use in the course of eligible farming activities; AND

- the farmer provides (and the seller retains) an exemption certificate in this regard.

See Form L402 Fuel Charge Exemption Certificate for Farmers fillable pdf. Each qualified farming customer should complete this form, if they have not previously done so, and provide a copy to their fuel supplier and retain a copy for themselves.

Should you need more information on the Federal Fuel Charge (Carbon Tax) you can:

Visit: https://www.canada.ca/en/revenue-agency/services/tax/excise-taxes-duties-levies/fuel-charge.html

Changes to British Columbia Carbon Tax Rates

On April 1, 2023, BC carbon tax rates will be increasing. As a reminder, here is a list of the relevant fuels at UFA that are subject to the carbon tax and new rates effective April 1, 2023:

* Light fuel oil – subcategories of light fuel oil include:

- Diesel

- Locomotive fuel

- Heating oil

- Industrial oil

Qualifying Farmers in BC purchasing coloured fuel will need to fill out the FIN458 Form (Certificate of Exemption Farmer) to be exempt from the Motor Fuel and Carbon Taxes.

For More information on Motor Fuel Tax and Carbon Tax Exemptions in BC please visit: https://www2.gov.bc.ca/gov/content/taxes/sales-taxes/motor-fuel-carbon-tax/business/exemptions

For more information:

Visit: https://www2.gov.bc.ca/gov/content/taxes/sales-taxes

Toll free in Canada: 1 877 388-4440

Email: CTBTaxQuestions@gov.bc.ca